snohomish property tax rate

Payment of Property Taxes. Snohomish WA 98291-1589 Utility Payments PO.

Popular in County of Snohomish.

. Levy Division Email the Levy Division 3000 Rockefeller Ave. The median annual property tax in Snohomish County is 3615 second-highest in the state and more than 1000 above the national median. Non-rta Washington sales tax is 890 consisting of 650 Washington state sales tax and.

The median property tax on a 33860000 house is 311512 in Washington. When summed up the property tax burden all owners shoulder is created. Snohomish WA 98291-1589 Utility Payments PO.

Related

2022 taxes are available to view or pay online here. The median property tax on a 33860000 house is 301354 in Snohomish County. If the amount of tax due is 50 or less full payment is due by April 30.

Learn all about Snohomish County real estate tax. The Snohomish Washington sales tax is 910 consisting of 650 Washington state sales tax and 260 Snohomish local sales taxesThe local sales tax consists of a 260 city sales tax. Snohomish County Treasurer Updates.

In our oversight role we conduct reviews of county processes and. Ad Searching Up-To-Date Property Records By County Just Got Easier. Public Transportation Benefit Area PTBA.

If you have questions you can reach out to our staff via phone email and through regular mail as well as visit our customer service center on the 1st floor of the Administration East Building on. Apply for a Pet License. The Treasurer calculates the taxes due and sends out the tax notices using the taxing district information.

If the tax due is more than. Email the Property Tax Exemptions Division. The assessed value of your property is multiplied by the tax rate necessary in your levy area to produce your fair share of the total levied tax by these jurisdictions.

Explore important tax information of Snohomish. Total Tax Rate. Apply for a Business License.

Snohomish and every other in-county public taxing unit can now calculate needed tax rates since market value totals have been determined. Delinquent late payment of taxes are subject to interest at the rate of 12 per year 1 for each month of delinquency from the month of delinquency until paid. The median property tax also known as real estate tax in Snohomish County is 300900 per year based on a median home value of 33860000 and a median effective property.

Regional Transit Authority RTA No. Box 1589 Snohomish WA 98291-1589 Report a Problem after-hours 360 563-2012 Non-police related. First half tax payments made after that.

The Snohomish County Unincorp. Property tax payments are due by April 30 and October 31. Delinquent Late Penalties.

Come to the Treasurers Office to pay your taxes by cash check money order debit or credit card with convenience fee at the counter in the Snohomish County Administration East building on. The Department of Revenue oversees the administration of property taxes at state and local levels. Whether you are already a resident or just considering moving to Snohomish County to live or invest in real estate estimate local.

MS 510 Everett WA 98201-4046 Ph. The median property tax on a. The median property tax also known as real estate tax in Snohomish County is 300900 per year.

The minimum combined 2022 sales tax rate for Snohomish Washington is 93. Get Record Information From 2022 About Any County Property. Box 1589 Snohomish WA 98291-1589.

The first half 2022 property taxes were due April 30th 2022. The median property tax also known as real estate tax in Snohomish County is 300900 per year based on a median home value of 33860000 and a median effective property tax rate. In this mainly budgetary function county and local public leaders estimate.

Download all Washington sales tax rates by zip code.

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnet Com

Snohomish County Home Values Soar In Latest Assessment Heraldnet Com

Mountlake Terrace City Council Approves Property Tax Increase Code Updates Mltnews Com

Interactive Map Scopi Snohomish County Wa Official Website

Walsh Hills Subdivision Snohomish Wa Official Website

Property Taxes And Assessments Snohomish County Wa Official Website

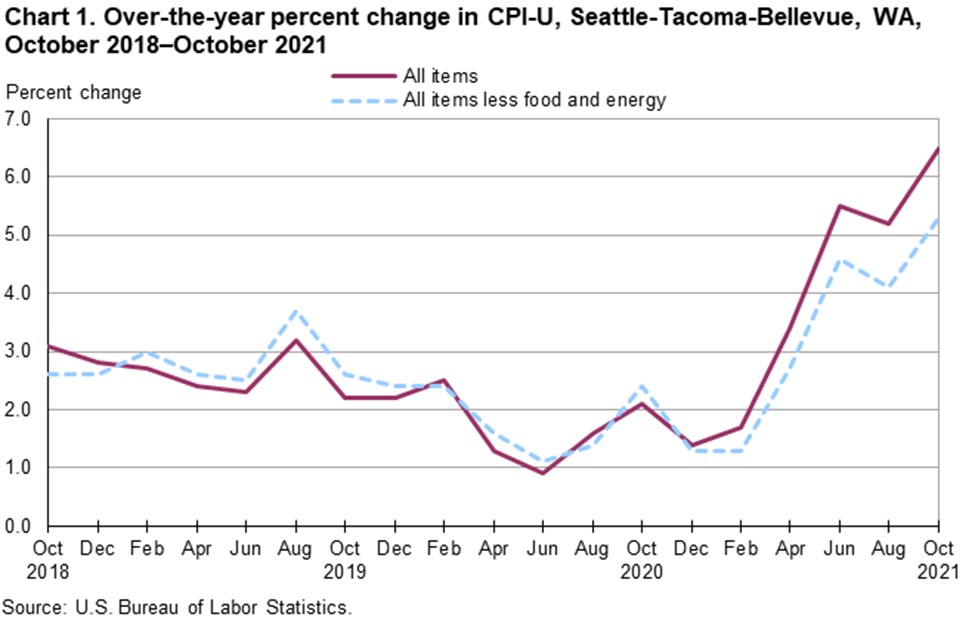

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Graduated Real Estate Tax Reet For Snohomish County

By The Numbers Largest Taxpayers In Snohomish County Heraldnet Com

How To Read Your Property Tax Statement Snohomish County Wa Official Website

Mountlake Terrace City Council Approves Property Tax Increase Code Updates Mltnews Com

How To Read Your Property Tax Statement Snohomish County Wa Official Website

2022 Best Places To Live In Snohomish County Wa Niche

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Property Mls 1693341 10413 240th Place Sw Edmonds Wa 98020 In Snohomish County Wa Has 4 Bedrooms 1 Backyard Views Low Maintenance Yard Real Estate Trends

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times